Better Than Candy

In finance, "innovation" often just means new ways to separate people from their money. The rise of levered ETFs and structured products are some of these "innovations." They can be entertaining — like a roulette wheel is entertaining — and sound sophisticated but rarely do better than simpler solutions.

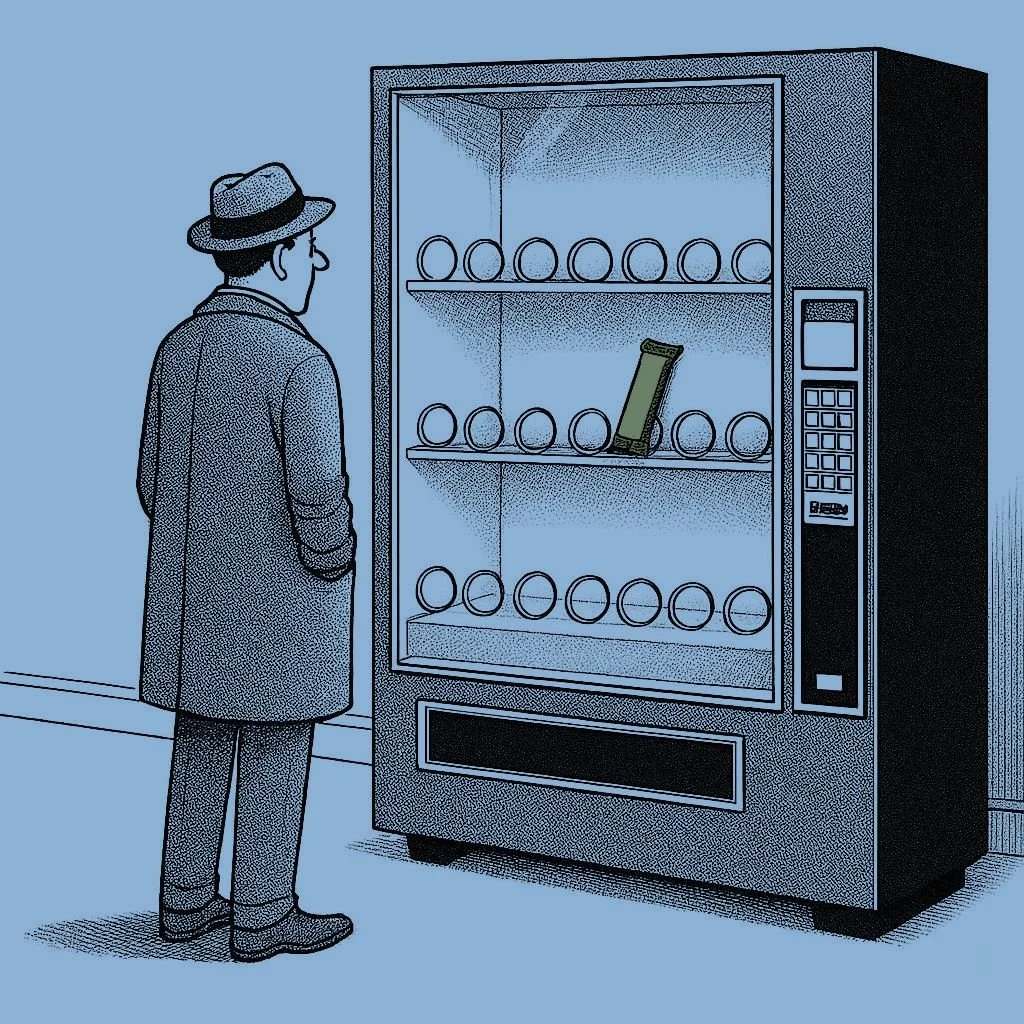

A few financial innovations really have helped consumers, though. ATMs are one. They've been around since the 1970s. John Shepherd-Barron had the idea when he showed up to his bank to get cash one Saturday a minute late. Miffed, John grumbled "I can get a damn chocolate bar from a machine any time I want, but I can't get my own money?" So, he came up with a vending machine for cash: the ATM.

The idea is in the name — Automated Teller Machine. No actual teller needed. The boxes help consumers because they're quick, easy, and accessible 24/7. Banks like them because they're far cheaper than a new branch or even a new branch employee.

But a few other more recent financial innovations have put the ATM on the back burner — first digital payments then mobile banking.

Who even uses cash anymore? Who uses physical bank cards?

Small bills only

Turns out lots of folks still use cash. Consumers handed over bills for 14% of stuff they bought in 2024. Four out of five folks in the US still keep cash on-hand. The share of cash used in buying stuff has been going down, but not to zero. There's still some cash that’s going to stick around.

Banks still need to get customers their money somehow. ATMs are the easiest, cheapest solution for everyone.

Two companies in North America provide most of the ATMs. NCR Atleos is one. The company spun-off from parent, NCR, back in October 2023. Most of its business comes from operating ATMs for banks. It does this keeping ATMs inside banks running and it runs its own network of ATMs that anyone can use.

So, is NCR Atleos just banking on the last gasps of a dying market?

Yellow brick road

The number of bank branches began declining after the Great Financial Crisis. COVID-19 accelerated the fall. Fewer banks mean a shrinking total market for ATMs. Now, in 2025, banks have announced plans to start opening new branches again over the next few years.

Banks want to expand. They don't want to spend a lot on low-value teller services. They want to put in more people in branches selling levered ETFs and structured notes and other fun stuff — things where they make a lot more money. The tellers at these new branches, as much as banks can manage it, will be automated. More banks and more ATMs in those banks will offer some tailwinds for the overall ATM market.

All-digital banks want to expand too. Some have been pretty successful. They aren’t going to have any branches at all. They still need to give customers some access to physical cash, though. That’s table stakes. They’ll need ATMs.

Turning on a dime

In part, to ease this new bank branch world, NCR Atleos staked its future on providing ATM services rather than selling ATMs. Like software companies pivoting to software as a service — "Saas" — NCR Atleos wants to sell "Aaa"…yeah, well… "ATMs as a service."

NCR Atleos can manage the growing fleet of in-branch ATMs and the ones in the wild digital banks need to offer their customers.

Banks like this because it offloads some of the risks for owning ATMs — maintaining ATMs isn't a core-competency for them. It also gives them flexibility to upgrade to the latest tech without the hassle of doing that themselves — that happens at NCR Atleos. This arrangement works for the company because it turns a lumpy one-time sales business into a steady stream of cash flows. These types of businesses are easier to manage for execs and get more favorable attention from investors.

Cashing in

So, we have:

Banks opening up more branches

More ATMs in banks and more services taken over by ATMs

A shiny new service-oriented business model

More branches serve NCR Atleos an expanding market for the first time in a decade. That market is exactly the one where it’s the leader. Banks using ATMs for more functions means more ATMs for each location and a sharpened focus on reliability. Whatever banks can delegate to ATMs, they will. A service-oriented model means more flexibility for the banks and steadier income for the company.

Investors like growing markets. They like favorable mix shifts. They love subscription-like businesses. They should like NCR Atleos, right?

Investors have struggled to get past the "cash is dying" headline. They’re also put off by years of lackluster management while NCR was still just one company. This has capped NCR Atleos' share price. As the business spends more time in the public eye, continues to perform and proves out its new business model, its share price will reflect that. In the meantime, Lamplighter was happy to pick up shares like they're coming out of a broken vending machine.

Disclaimer: None of this is investment advice. It's meant to illustrate ways LCM thinks about investing. Things that LCM decides are good investments for LCM and its clients are based on many criteria, not all of which are covered here. Some or all of LCM's ideas may not be suitable for other investors. LCM does not recommend investing either long or short any position mentioned. LCM may own positions in some of the companies mentioned. Some of its ideas will lose money — investing entails risk. See full disclaimer here.