It’s a blog.

It’s educational.

It’s hopefully entertaining.

It’s not investment advice.

How to think about investing.

Where the Staircase Ends

What’s a business’ final investment? How many steps between here and the one where shareholders get cash from it? How to evaluate shareholder-friendly policies in a booming business.

Something Fishy

Do sardines make good investments? What should you do if trading in a company’s shares smells fishy? How to distinguish whether a company is trading just on vibes or something real.

Gold Rush

How do you figure out if an investment’s pure gold? What about the things you need to get to the gold… like picks and shovels? How to evaluate “pick and shovel” opportunities in AI.

Bird’s Eye View

How would a bird look at a portfolio? Does a book of investments look different all grouped together? A look through at the business activity of the portfolio.

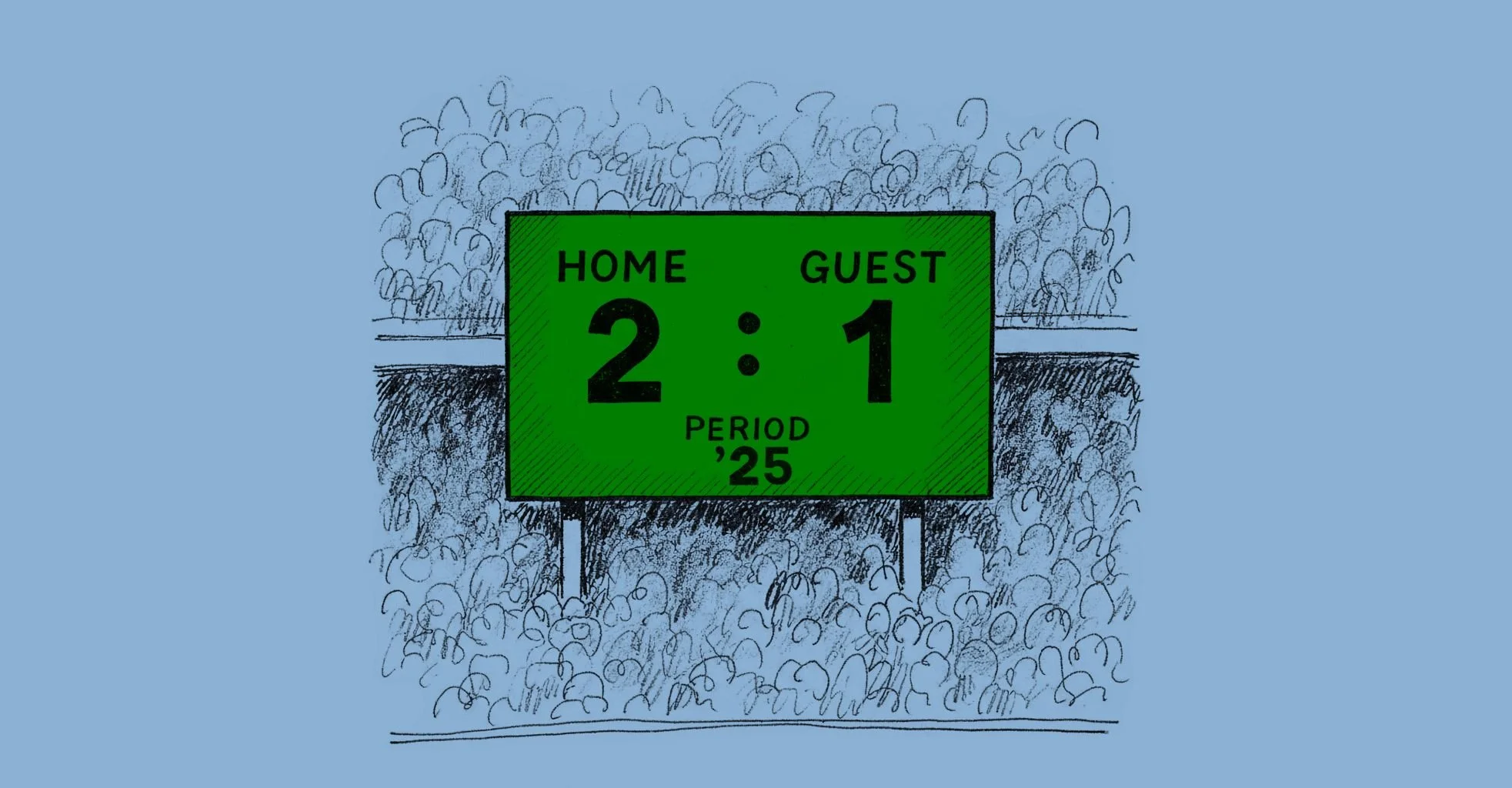

2025 Scoreboard

Lamplighter made some predictions for its portfolio in 2025. Some things it got right. Some things it got wrong.

Jackass of All Trades

What’s wrong with you? Why do you make so many bad decisions? How to evaluate mistakes from the year.

Fair Warning

What even is a foul in financial markets? Does it matter to companies if their shareholders prompt a warning from their exchange? How to evaluate an attempt to upgrade a company’s investor base.

Stone Soup

What are the ingredients for a good special situations investment? What if investors’ palettes find those ingredients off-putting? Evaluating opportunities when shareholders have a cornucopia of reasons to sell.

Guess Who?

What value do board games offer in the digital age? If its a digital game, how can you tell if your opponent is real? How to evaluate the value of “real” in the age of AI-powered fraud.

One Last Job

What would it take to bring you back for one last job? It works in the movies, does it work for companies? How to use exec pay pay packages to evaluate investments.

Stack the Deck

Pick a card. Any card. Does it matter which card you pick investing in AI? How to evaluate different pieces of the AI stack and one AI bundle.

The Old Ball and Chain

Does being chained to a dying industry hold back an investment? What happens when that ball and chain start to feel lighter? How to think about Garrett Motion’s link from combustion engine turbos to a zero-emission future.

Pins and Needles

Does an investment ever get under your skin? What if it stays there? How to evaluate businesses that don’t sell anything yet.

Better Than Candy

Do vending machines ever have anything worthwhile? What if there’s only one choice? How to assess the value of convenient cash when things are increasingly cashless.

Frame Store

What kind of frame should you use for a Rembrandt? Should you use that same frame for an investment? How to think around investment ideas to build what works for your portfolio.

Shorts Story

What’s the right attire for doing financial research? What’s the point of short reports anyway? How to think about “the shorts” when they take shots at your shares.

High Wire Act

Is it always best for technology companies to invest through their P&L? How do investors think about big fixed investments in tech? How to evaluate Google’s search for the highest and best returns.

On Your Mark

How fast do you have to run to run a business? What do track stars have to do with running a business? How to find opportunity in the race to boost safety and profits in warehouses and shipping.

What to Expect When You’re Expecting

What do investors expect when they make a new investment? What does share price tell us about their expectations? How to use low expectations to find attractive investment opportunities.

Good Cop, Bad Cop

Does the Good Cop/Bad Cop routine work in markets? What happens when there’s just one cop? How to evaluate companies that run both good businesses and bad ones.