Where the Staircase Ends

Somewhere, in a steel and millwork boardroom an end-of-year recap happens.

The CEO marches in: "Aye! Boss! We had a good year."

Board Chair: "How good?"

CEO: "We've got cash stashed everywhere. What do you want me to do with it?"

Chair: "Grow faster. Drive it back into the business."

CEO: "We’re at capacity. We've got a couple projects bending metal. We're a bit stretched on hammers to bang them together. It'll take months, maybe years to get new gear."

Chair: "Buy someone else then — one of our competitors, a supplier?"

CEO: "We could try to buy a competitor, but we already have the best processes and tech in-house. They're also bigger than us. It would throw us right in regulatory crosshairs — antitrust and national security. Better odds flipping a coin than getting that over the finish line. We could buy a supplier, but those are pretty big too and sell stuff we don’t use."

Chair: "Fine. Pay down some debt then."

CEO: "We flipped to a net cash position. We're not gonna get any return paying down more debt."

Chair: "What then?"

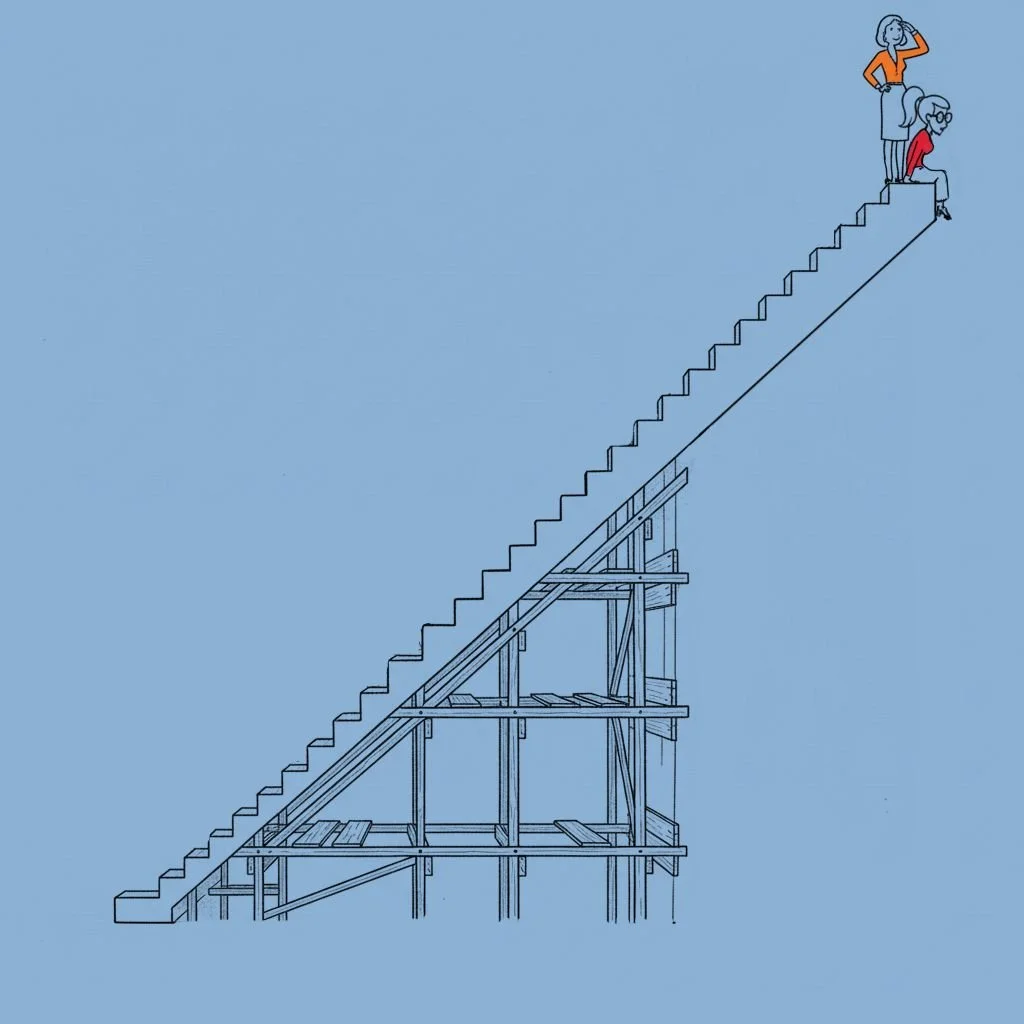

Step by step

The conversation climbs the usual staircase of spending ideas. Each alternative is a possible avenue to increase or blow share value. At the last flight, this is where the CEO usually comes up with some crypto treasury scheme or a move into real estate or into "AI something" or another dumbass idea.

What about allocating some capital to shareholders?

Capital allocation stories are good ones for bedtime. They're dull. Lamplighter's told some of them before. Capital allocation heroes grow slowly. They manage expenses. They eat their vegetables. They dutifully return cash to shareholders. Either they pay dividends or buy back shares. Or both.

Usually, shareholders drag management kicking and screaming to this.

Anyway, here's SK Hynix, a memory maker, uncorking their 2025 results like a confetti canon.

Capital adventure

It grew revenue 47%. It grew profit 101%. Both grew from previous records. The market expects topline to double in 2026. 2026 capacity is already sold out. It has three new facility projects in the works in Korea, China and the US. Hardly boring stuff.

It already pays a dividend. It increased that. It announced it would top-off shareholders with a special dividend as much as its regular one. It launched a share buyback program, its largest by orders of magnitude.

Management and the board would probably love to put all this cash back into the company to meet surging demand, if it could. It's hard to bring on new memory making capacity. It takes time and lots of machines. Supply chains are long. SK Hynix and other memory makers have been burned before. So, they only do this methodically.

In the meantime, cash is piling up. Balances rose 50% in 2025. Management dusted off some shareholder-friendly moves. The amounts won't break the bank. Cash will still come in faster than it’s going out. Management couldn't use it all to pay shareholders, though.

In classic exec fashion, the C-suite also embarked on a vague, US-based AI solutions arm. Will it add anything? Who knows. It won't cost too much relative to the other capital allocation efforts. On the spectrum of management side-quests, it's pretty benign.

Next step

Salad days won't last forever. Right now, though, the business cooks. Management has taken steps to be prudent about the payday. SK's share price has noticed. It's not quite so cheap as it was. Demand is still strong and expectations haven't quite caught up. Tightness in memory looks set in till at least 2028. The combination of climbing demand and a friendly turn by management towards shareholders could carry SK’s shares up.

Disclaimer: None of this is investment advice. It's meant to illustrate ways LCM thinks about investing. Things that LCM decides are good investments for LCM and its clients are based on many criteria, not all of which are covered here. Some or all of LCM's ideas may not be suitable for other investors. LCM does not recommend investing either long or short any position mentioned. LCM may own positions in some of the companies mentioned. Some of its ideas will lose money — investing entails risk. See full disclaimer here.